Dear Inland Lakes Community,

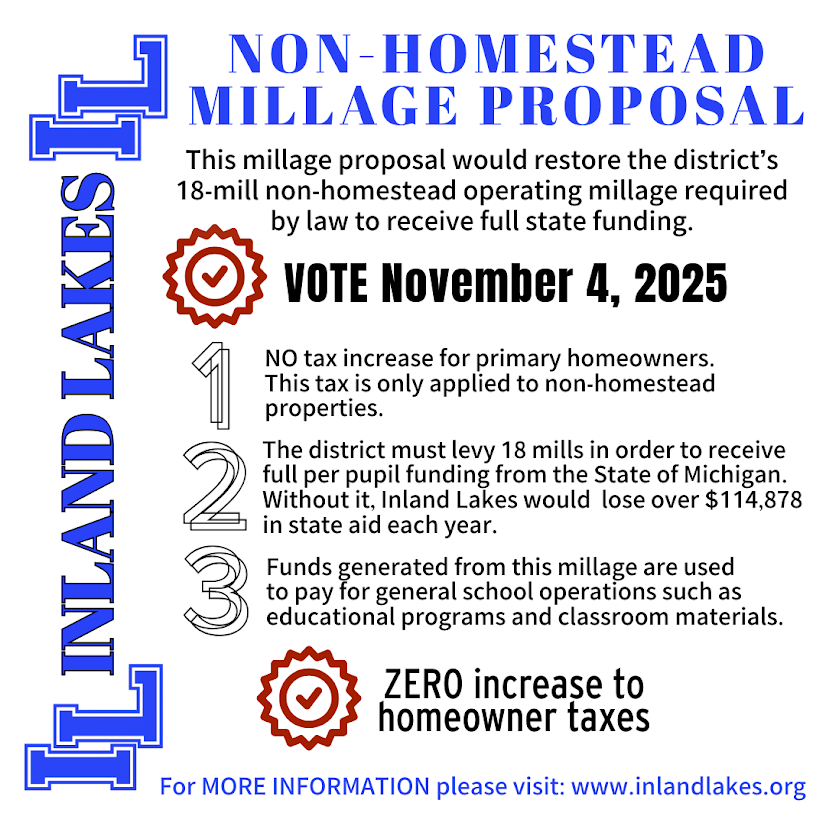

On Tuesday, November 4, 2025, you will see a proposal to restore Inland Lakes Schools’ Non-Homestead Operating Millage. I want to share what this means in simple terms.

This proposal, if approved by the voters, would not raise taxes on your primary home. It applies only to non-homestead property—such as second homes, rental properties, and commercial property. Homestead properties (primary homes) are exempt from the millage.

The State of Michigan requires school districts to levy 18 mills on non-homestead property to receive the full per-pupil foundation allowance. Restoring this millage would keep us eligible to receive those state dollars. If the millage is not restored, Inland Lakes Schools would lose more than $114,878 each year in state aid. These funds are part of our day-to-day operations—things like educational programs, classroom materials, and student supports that help our Bulldogs learn and grow.

Thank you for taking the time to understand this proposal. If you have questions, please contact the district office. I’m happy to talk more and make sure you have the information you need.

With appreciation,

Elizabeth Fairbanks

Superintendent, Inland Lakes Schools